Ever heard of a long-term visa that lets you live in a beautiful country like Spain without needing a local job? That's exactly what a non-lucrative visa is. It’s a residency permit designed for people who are financially self-sufficient, like retirees or anyone with a solid passive income, allowing them to support themselves and their families abroad.

Understanding the Non Lucrative Visa

Think of the non-lucrative visa (NLV) as a special key. It unlocks the door to living in a country like Spain for a year or more, but with one simple rule: you can't use it to get a job in the local market. The entire visa is built on the foundation of your financial independence.

This visa is perfect for anyone who doesn’t need to earn a local salary to pay their bills. It’s a residence permit for those who bring their financial stability with them.

Who Is This Visa For?

The ideal candidate for an NLV has a steady, reliable income stream that comes from outside the country they want to live in. This isn't as narrow as it sounds and fits several common profiles:

- Retirees: Anyone receiving consistent pension payments or Social Security benefits.

- Investors: People living off dividends from stocks, interest from savings, or other investment returns.

- Property Owners: Those who earn reliable rental income from properties back home or elsewhere.

- Remote Workers: In certain situations, people who work for foreign companies can qualify. The key is that the consulate doesn't see their work as "active" local labor.

The big idea here is that you'll be a resident who contributes to the local economy through your everyday spending—renting an apartment, shopping at local markets, and eating out—all without taking a job from a local citizen.

The NLV's primary purpose is to attract residents who can support themselves entirely through savings or passive income, ensuring they contribute economically without placing a burden on the national employment system.

The Non Lucrative Visa at a Glance

To really get a handle on this, let's break down the core components of the non-lucrative visa. These pillars give you a quick, high-level look at what the visa is all about and whether it’s the right fit for your plans.

The table below gives you a snapshot of its purpose, main requirements, and key benefits.

| Core Pillar | Description |

|---|---|

| Purpose | To grant temporary residency to financially independent non-EU citizens who wish to live in a country without conducting any local work. |

| Financial Proof | You must demonstrate sufficient funds, typically through savings or passive income streams like pensions, investments, or rental income. |

| Work Restriction | You are strictly prohibited from engaging in any "lucrative" or professional activity within the host country’s local job market. |

| Initial Duration | The first visa is typically valid for one year, with the possibility of renewal for longer periods, eventually leading to permanent residency. |

| Major Benefit | It provides a stable, long-term path to living in Europe, including visa-free travel within the Schengen Area, without needing a job offer. |

Ultimately, the non-lucrative visa is a bridge for anyone dreaming of an extended stay or retirement in Europe. It’s your way of showing you have the financial footing to enjoy a new life without needing to rely on the host country's job market, making it a popular and straightforward path to residency.

Meeting the Financial Requirements

Of all the hurdles in your visa application, this is the big one: proving you can support yourself financially. Think of it from the country's perspective. They’re welcoming you to live there, and in return, they need to know you won’t become a financial strain on their system. This entire section is about showing them you have the stability to live comfortably on your own dime.

And it's not just about having a pile of cash in the bank, though that certainly doesn't hurt. What consulates really want to see is reliability and consistency. A steady, predictable stream of income, even a modest one, often carries more weight than a sudden, unexplained lump sum that just appeared in your account.

Decoding the Financial Thresholds

Every country sets its own financial bar, but many, like Spain, use a national benchmark to figure out the minimum you need to have. In Spain, this is called the IPREM (Indicador Público de Renta de Efectos Múltiples). Don't get bogged down by the name—just think of it as a baseline financial unit the government uses for all sorts of calculations.

The rule of thumb for a primary applicant is to prove you have access to 400% of the IPREM annually. This ensures you can cover your living costs without needing to find a job locally. For 2025, this means Spain’s Non-Lucrative Visa requires you to show at least €2,400 per month (which works out to €28,800 for the year). If you're bringing family, you’ll need an extra €600 per month (€7,200 annually) for each dependent.

This model is pretty common. While Spain uses the IPREM, another country might peg its requirements to the national minimum wage or a different economic index. The core principle is always the same: prove you can stand on your own two financial feet.

What Counts as Acceptable Income

So, what kind of money are we talking about? Consulates are looking for passive, non-lucrative income—money you aren’t actively earning inside their borders. These are the sources they love to see:

- Pensions and Social Security: For retirees, this is the gold standard. An official letter from a government agency or private pension fund is rock-solid proof.

- Investment Income: Got dividends from stocks, returns from mutual funds, or interest from bonds? Perfect. You'll just need statements that show those payouts happening consistently.

- Rental Income: If you own property and collect rent, that’s an ideal source of passive income. Get a formal lease agreement and bank statements showing the deposits hitting your account like clockwork.

- Savings: A healthy savings account can definitely do the trick. The key here is history. Consulates want to see that the money has been sitting in your account for a good while—think 6 to 12 months at least. This shows it’s your money, not a last-minute loan from a friend to pad your application.

Key Takeaway: Your goal is to paint a clear picture of long-term financial stability. A smart mix of savings and a reliable passive income stream is usually the most convincing combo for a successful application.

How to Prepare Your Financial Documents

Being organized is your best friend here. It’s not enough to just have the money; you need to present proof in a way that’s clean, official, and dead simple for the consulate to verify. Messy or incomplete paperwork is one of the top reasons for rejection.

Here’s a quick checklist to get you started:

- Bank Statements: Pull together at least six months of statements, but twelve is even better. Make sure they clearly show your name, the bank’s logo, and a consistent balance.

- Official Letters: Get formal letters from your pension provider or investment firm. They need to be on official letterhead and state the regular amount you receive.

- Tax Returns: Your last one or two years of tax returns are great for backing up your income claims and showing a history of financial stability.

- Proof of Other Assets: If you have significant real estate or other investments, include official documents that verify their value.

While the non-lucrative visa is a fantastic route for anyone with passive income, it's not the only game in town. For example, if your income comes from remote work, you might want to look into the D7 Passive Income Visa, which has a different set of rules that could be a much better fit.

And one final tip: make sure any documents not in the country’s official language are translated by a certified translator. It’s a small step that prevents huge delays.

Your Step-By-Step Application Process

Embarking on the non lucrative visa journey can feel like you're trying to assemble a complex piece of furniture without the instructions. But with a clear plan, each piece falls perfectly into place. Think of this process less like a bureaucratic nightmare and more like a project plan for your new life in Spain. We'll break it down into manageable stages, from gathering your first documents to that exciting moment you finally get your residency card.

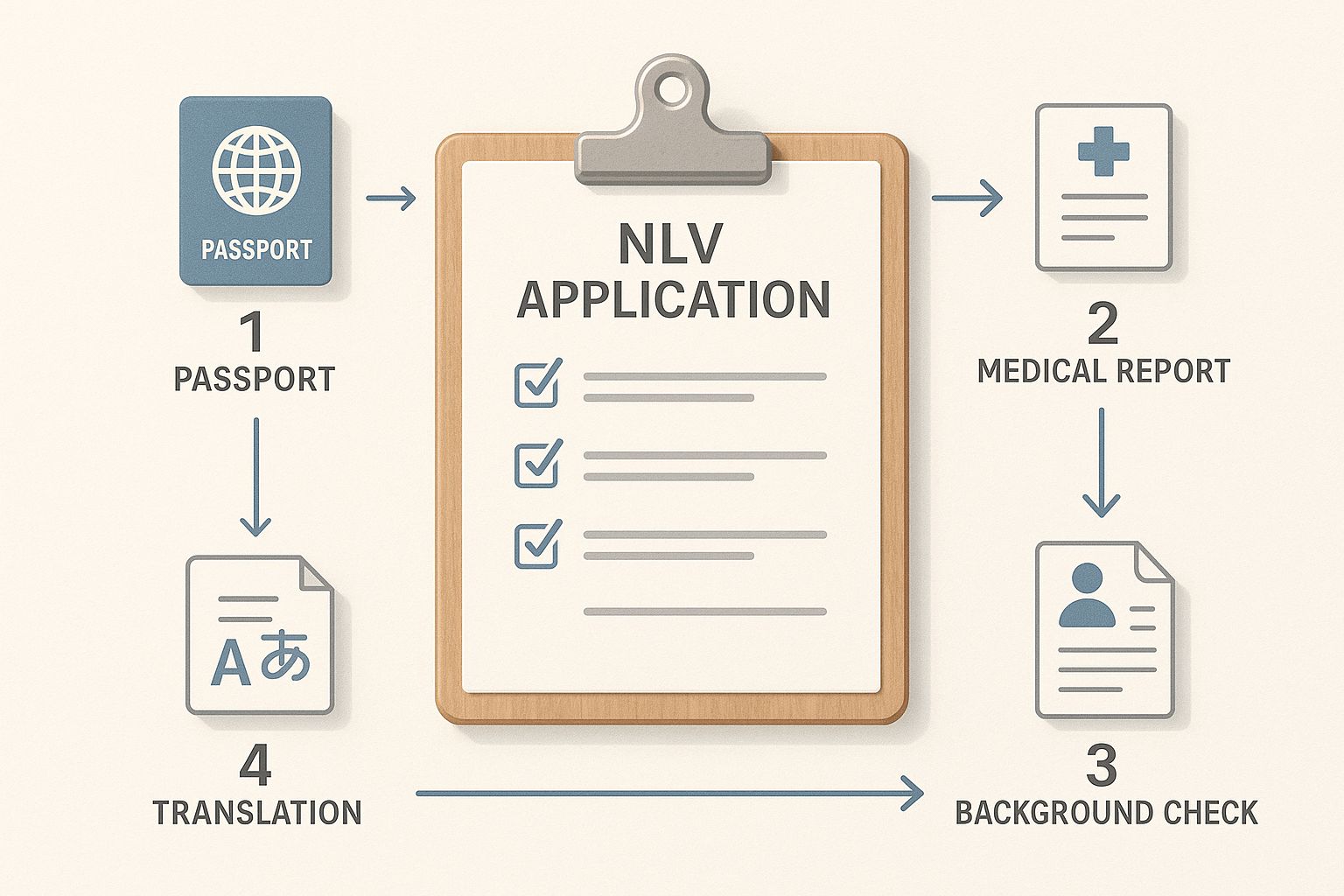

This visual guide gives a bird's-eye view of the essential documents and steps you'll be taking.

As you can see, a successful application is really built on four pillars: identity, health, legal standing, and translation. Getting each one right is non-negotiable.

Stage 1: Gathering Your Core Documents

This first phase is all about getting organized. Trust me, the amount of paperwork can feel overwhelming, so do yourself a favor and create a checklist and a dedicated folder right from the start. While the specifics can vary slightly between consulates, the core set of documents is remarkably consistent.

Your first mission is to collect the essentials that prove who you are, that you're in good health, and that you have a clean legal record.

- Valid Passport: This one's a given. Make sure your passport is valid for at least one year beyond your intended stay in Spain and has plenty of blank pages.

- Proof of Health Insurance: You’ll need a private Spanish health insurance policy (or one from a company authorized to operate in Spain). It has to offer full coverage with zero co-payments or waiting periods and must include the repatriation of remains.

- Medical Certificate: This is a formal letter from your doctor, on their official letterhead, stating you are free from any diseases that could pose a public health threat under international regulations.

- Criminal Background Check: You'll need a criminal record certificate from your home country and any other country where you’ve lived for the past five years.

Stage 2: The Legalization and Translation Phase

Once you have your core documents, they need to be prepped for international use. This is where two critical, and often confusing, steps come in: apostilles and official translations. Skipping or messing up these steps can bring your entire application to a screeching halt.

An apostille is basically an international notary seal that verifies a document for use in countries that are part of the 1961 Hague Convention. You'll definitely need to get an apostille for your criminal background check and potentially other official records, like birth or marriage certificates if you're applying with family.

The whole non-lucrative visa process is time-sensitive. Many key documents, like your medical certificate and background check, must have been issued within three months of when you submit your application. Timing this carefully is absolutely essential to prevent documents from expiring mid-process.

After your documents are legalized, anything not in Spanish has to be translated. And you can't just ask a bilingual friend for help. The translation must be done by a sworn translator certified by the Spanish government. Your local consulate will have a list of approved translators to ensure your documents are interpreted accurately and officially.

Stage 3: The Consulate Appointment and Submission

With your perfectly compiled, translated, and apostilled document package in hand, it's time for the main event: your consulate appointment. You have to apply through the Spanish consulate that has jurisdiction over your state of residence. Booking these appointments can be tough, so it’s smart to get your slot secured as far in advance as you can.

During the interview, a consular officer will go through your application, check your documents, and might ask a few questions about why you want to move to Spain. Be ready to submit everything in hard copy, along with your passport and the visa application fee.

Stage 4: Post-Approval and Your Move to Spain

After you submit everything, the waiting game begins. This can take anywhere from a few weeks to several months. Once you get the good news, the consulate will place the visa sticker right into your passport. From that issue date, you typically have 90 days to enter Spain.

But your journey isn't quite over when you land. You have one final, crucial step to complete within your first month.

- Register with the Local Town Hall (Empadronamiento): This officially registers you as a resident of your new city or town.

- Apply for Your TIE (Tarjeta de Identidad de Extranjero): This is your foreigner identity card—the physical proof of your residency. You'll need to book an appointment at the local immigration office or police station to get your fingerprints taken and submit your final paperwork.

Getting your TIE is the finish line. It solidifies your legal status and lets you finally settle into your new life. While these are the specific steps for Spain, it's interesting to see how other countries handle things. For anyone looking at Portugal, for example, getting a fiscal number is a key early step. You can learn more about how to get a NIF number in Portugal in our complete guide, which gives some great insights into that country's process.

Why This Visa Is More Important Than Ever

The landscape of European residency is shifting, and the non lucrative visa is quickly moving into the spotlight. For a long time, the simplest path to living in countries like Spain or Portugal was the "Golden Visa," a program that typically offered residency in exchange for a hefty real estate investment. But that door is closing, fast.

Governments across Europe are hitting the brakes on these investment-for-residency schemes. They've realized that a one-time property purchase, which can drive up housing prices for locals, isn't as beneficial as attracting residents who are financially self-sufficient. The new priority is to welcome people who contribute to the local economy by living and spending there consistently.

This is where the non lucrative visa shines. It was designed from the very beginning for this exact person: someone who can support themselves without taking a job from a local, bringing their own financial stability to the table.

The End of an Era for Golden Visas

The move away from real estate-based residency isn't just a rumor; it's a clear and accelerating trend. One by one, European countries have either shut down or drastically changed their Golden Visa programs, making a property purchase a much less certain ticket to a new life abroad.

This isn't just some minor policy adjustment. It's a fundamental change in thinking. Countries now favor residents who plan to stick around, integrate into the community, and make sustainable, long-term economic contributions.

Just look at the recent headlines:

- Portugal: Scrapped its popular real estate investment option for the Golden Visa back in October 2023.

- Greece: Overhauled its program in 2024, jacking up the investment minimums in major cities.

- Spain: Pulled the plug entirely, announcing the termination of its Golden Visa program, effective April 3, 2025.

This domino effect sends a loud and clear message. For non-EU citizens, the future of European residency is tilting away from big, passive investments and towards proven financial independence.

The decline of the Golden Visa isn't just closing a door; it's opening a much wider one for the non lucrative visa. It has consistently proven to be a more stable, resilient, and government-favored pathway for long-term residency.

Spain's Policy Change a Case Study

What's happening in Spain is the perfect real-world example of this massive shift. The moment the government announced it was ending its Golden Visa, all eyes turned to the non lucrative visa. The numbers tell the whole story.

After Spain's government announced the program's end in April, there was a last-minute scramble. Between January and October 2024, Spain issued 780 Golden Visas, but a whopping 73% of those were pushed through after the shutdown was announced. This final rush just underscores how the ground is shifting. You can get more details on Spain's Golden Visa ending on GlobalCitizenSolutions.com.

This policy change has cemented the non lucrative visa as the go-to route for countless aspiring expats. It's no longer just an alternative; for many, it's now the most secure and logical path to their dream of living in Spain. The NLV represents a more authentic way to become a resident—one based on actually living in the country and participating in its economy, not just owning a piece of it. In an era of unpredictable policy changes, it's the resilient choice.

The Lifestyle You Can Build with an NLV

Once you’ve navigated the paperwork and have that visa in your passport, the real adventure begins. Think of the non-lucrative visa less as an entry permit and more as a key. It's the tool that unlocks your dream of slow travel, deep cultural immersion, and long European summers, turning it from a distant fantasy into your day-to-day reality.

This visa is designed for people who are financially independent, giving you the freedom to build a life on your own terms. It’s not just about changing your address—it’s about fundamentally upgrading your entire lifestyle.

Unlocking Unprecedented Freedom and Flexibility

One of the first things you'll notice is the incredible freedom of movement. As soon as you have your residency card, you can travel visa-free throughout the 29 countries in the Schengen Area.

Imagine waking up in Madrid and, on a whim, deciding to spend the weekend exploring the ancient streets of Rome or relaxing on the sunny coast of Portugal. This kind of spontaneous travel, once a logistical headache, becomes a simple, everyday possibility.

Your new residency acts as a stable home base for countless adventures, all without the hassle of constantly applying for new visas. You can finally live like a local and travel like a European.

The real currency of the NLV lifestyle is time—the time to explore new places, to finally learn a new language, to pick up a forgotten hobby, or to simply embrace a slower, more intentional pace of life that felt out of reach back home.

This freedom isn't just geographical; it's financial, too. Since the visa is built for those with passive income, you can continue earning from sources outside your new home country. Financially independent people love the Non-Lucrative Visa because it’s permissive about asset ownership and passive income. Unlike the old Golden Visa programs, it doesn't force you into a massive property purchase. Your income can come from dividends, rental properties, or investments, as long as the work remains passive. You can learn more about the permissive income rules of Spain’s Non-Lucrative Visa on GlobalCitizenSolutions.com.

Building a Stable Foundation for the Future

But the lifestyle made possible by the non-lucrative visa is about more than just travel and leisure. It's about putting down roots and gaining access to the high quality of life Europe is famous for.

Property Ownership: Without the huge investment once required by Golden Visas, you can buy a home that actually fits your life, not a visa mandate. Whether you want a chic city apartment or a quiet villa in the countryside, the choice is entirely yours.

Access to Services: As a legal resident, you and your family can often tap into high-quality public services. This could mean enrolling your kids in excellent local schools or integrating into the national healthcare system after your first year.

Community Integration: Living in one place long-term lets you become part of the local community. You can join clubs, take classes, and build real friendships—creating the rich social life that’s impossible to find on short-term trips.

This stability is crucial, especially when you're planning a long-term move. Knowing how to budget for your new life is essential, and understanding the local cost of living makes all the difference. For a detailed breakdown of what to expect in a popular destination, check out our guide on the cost of living in Portugal for 2025. Ultimately, this visa gives you the framework to create a sustainable and deeply enriching life abroad.

Of course. Here is the rewritten section, adopting the expert, human-centric voice from the provided examples.

Common Questions About the Non Lucrative Visa

Even with the best preparation, a few tricky questions always pop up during the non-lucrative visa process. It's completely normal. This is where we tackle the common queries we hear from applicants every single day.

We'll give you straight, clear answers to cut through the confusion. From renewals to the thorny issue of remote work, let's get those lingering doubts sorted out so you can move forward with confidence.

How Do I Renew the Non Lucrative Visa?

Think of your initial one-year non-lucrative visa as a trial run. You're proving to Spain (or your host country) that you can live there comfortably without needing to join the local workforce. Once you've successfully completed that first year, you can apply to renew your residency.

The good news? The renewal process is generally much smoother since you're already in the country. The main thing is to show that you're still financially self-sufficient and have kept your private health insurance active.

Here’s how the timeline usually breaks down:

- First Renewal: After your first year, you can renew for a two-year residency permit.

- Second Renewal: Once those two years are up, you renew again for another two-year term.

After you've hit the five-year mark of continuous temporary residency (following the 1 + 2 + 2 year structure), you cross a major milestone: you become eligible for long-term or permanent residency.

Can I Work Remotely for a Foreign Company?

This is the million-dollar question and, honestly, the biggest grey area of the non-lucrative visa. The short answer is: it depends. The core rule is that you can’t engage in any "lucrative" (professional or economic) activity within the host country.

The confusion comes from how different consulates interpret "work." Some see remote work for a company outside of Spain as perfectly fine, since you're not taking a local job or serving local clients. Others take a much stricter view, considering any active work a violation, no matter where your employer is.

Critical Insight: It often boils down to "passive" vs. "active" income. If your money comes from investments, pensions, or rental properties, you're in the clear. If you have a full-time remote job that requires daily active work, you're venturing into risky territory. Always check with the specific consulate handling your application to get their official position.

What Is the Path to Permanent Residency and Citizenship?

The non-lucrative visa is a very stable and direct route to settling down for the long haul. After you've maintained your temporary residency for five continuous years, you can apply for permanent residency. This is a game-changer because it allows you to live and work in the country indefinitely with far fewer hoops to jump through.

The journey to citizenship is a bit longer. In Spain, for example, you can typically apply for citizenship after ten years of legal residency. This can be shorter for citizens of certain Ibero-American countries. Becoming a citizen grants you a Spanish passport and all the rights that come with being an EU citizen.

How Does This Visa Differ from a Digital Nomad Visa?

It’s easy to mix these two up, but they're designed for completely different people. Choosing the right one is critical for a successful application. The non-lucrative visa and the digital nomad visa serve fundamentally different purposes.

Let's break down the key differences.

| Feature | Non Lucrative Visa (NLV) | Digital Nomad Visa (DNV) |

|---|---|---|

| Primary Purpose | For financially independent people (like retirees or investors) to reside without working locally. | For remote workers and freelancers to legally work from the country for foreign companies. |

| Income Source | Primarily passive income like pensions, investments, or rental income. Significant savings also count. | Primarily active income from a remote job or freelance contracts with clients outside the country. |

| Work Allowance | Prohibits local work. Remote work is a major grey area and often not officially permitted. | Explicitly designed for and permits remote work. |

| Tax Implications | You typically become a full tax resident, taxed on your worldwide income. | Often comes with a special, more favorable tax status for a few years to attract skilled professionals. |

The bottom line is simple: the NLV is for living, the DNV is for working. If your income is passive, the non-lucrative visa is your best bet. If you have an active remote job, the digital nomad visa is the correct—and safer—choice.

Navigating visa requirements can be complex, but you don't have to do it alone. GetFastVisa specializes in turning relocation dreams into reality by managing the entire application process with expertise and confidence. From securing hard-to-get appointments to ensuring every document is perfect, our team is dedicated to your success.

Ready to start your journey to Portugal? Visit us at GetFastVisa to see how we can help.

Article created using Outrank

Tags

Guilherme Lima

Founder & CEO

Guilherme is the founder and CEO of GetFastVisa, a serial entrepreneur who previously co-founded two Fintechs recognized by the Central Bank of Portugal for his initiatives. Through his company and team, he has helped hundreds of applicants navigate the Portuguese visa application process by streamlining visa services and appointment booking, making Portugal relocation more accessible for digital nomads and entrepreneurs worldwide. Please note: Guilherme is not an attorney and does not provide legal advice.